Table Of Contents

Key Takeaways

- Overview of Indiana SR-22 insurance for reckless driving offenses

- Steps involved in acquiring an SR-22 in Indiana

- Effects of reckless driving convictions on insurance premiums

- Options available besides SR-22 insurance

- Frequently held misconceptions regarding SR-22 insurance

- Important factors to consider for SR-22 renewals

Indiana SR-22 For Reckless Driving Convictions | Understanding Indiana SR-22 Insurance

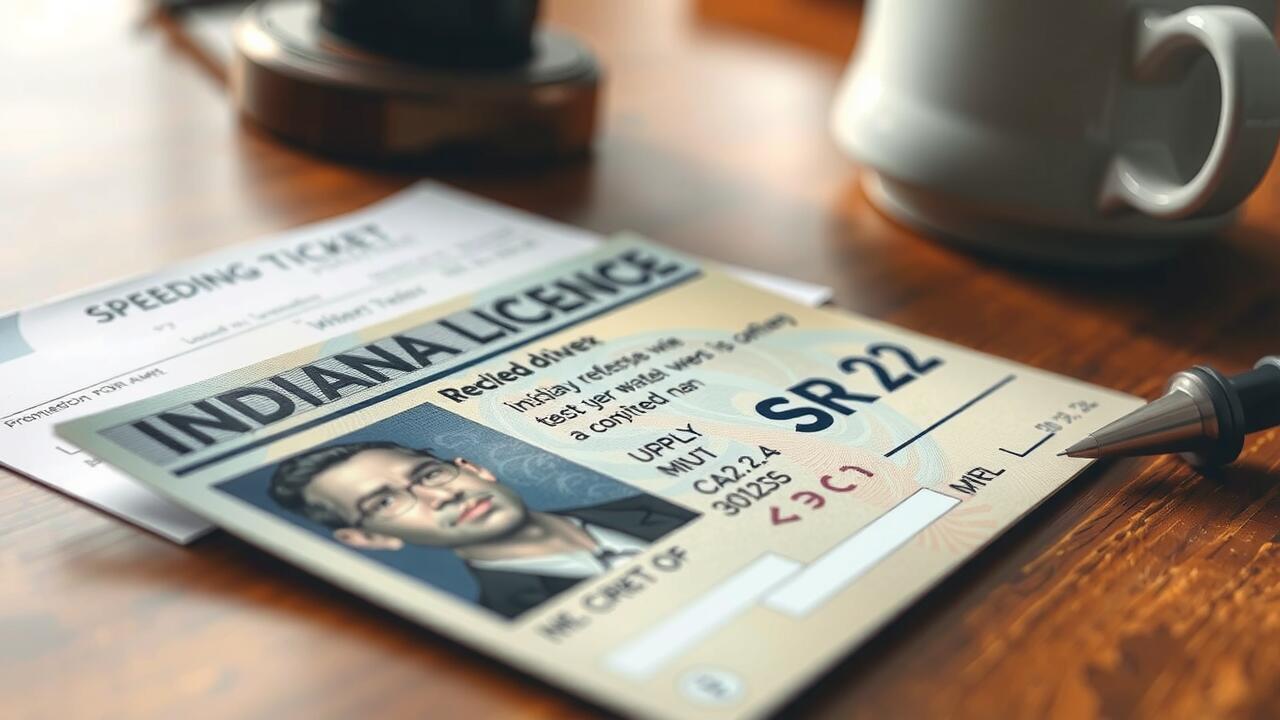

Indiana SR-22 for Reckless Driving Convictions serves as a critical form of insurance documentation for individuals who have been convicted of reckless driving or similar traffic offenses. This includes serious violations like reckless homicide, which may escalate the severity of the conviction to a felony level. The state of Indiana mandates that drivers with such convictions obtain an SR-22 to reinstate their driver’s license, ensuring they carry liability coverage as a safeguard for themselves and others on the road. Reckless driving not only impacts insurance rates but also reflects a pattern of recklessness that can have long-lasting repercussions on a driver's financial stability. Navigating the requirements of the Indiana SR-22 for Reckless Driving Convictions is essential for those looking to regain their driving privileges and demonstrate compliance with state regulations.

Indiana SR-22 for Reckless Driving Convictions | What is an SR-22?

An Indiana SR-22 for Reckless Driving Convictions is a document that proves a driver has the required insurance coverage after being convicted of specific traffic violations, including reckless driving and driving while intoxicated. This filing is mandatory for individuals whose driver's license has been suspended or revoked due to misdemeanors or criminal offenses. Maintaining a valid Indiana SR-22 ensures that drivers can reinstate their licenses and comply with state regulations, particularly for repeat offenders.

The SR-22 serves as a guarantee that the driver has sufficient liability coverage for any potential accidents or damages resulting from their driving behavior. It is essential for individuals looking to regain their driving privileges after serious traffic infractions. Enrolling in a defensive driving course may also benefit these drivers, as it helps to improve their skills and could potentially lower insurance premiums in the future. Understanding the requirements of an Indiana SR-22 for Reckless Driving Convictions is crucial to navigating the legal landscape of driver licenses in Indiana.

| Requirement | Description | Duration |

|---|---|---|

| SR-22 Filing | Proof of insurance required after a reckless driving conviction | Minimum of 2 years |

| Liability Coverage | Must meet Indiana's minimum liability insurance limits | Ongoing until SR-22 is no longer required |

| Defensive Driving Course | Recommended to improve driving skills and potentially lower premiums | Varies by course provider |

| License Reinstatement | Proof of SR-22 necessary to reinstate a suspended or revoked license | After meeting required conditions |

Importance of SR-22 for Reckless Driving

An Indiana SR-22 for Reckless Driving Convictions is a crucial requirement for motorists found guilty of serious offenses such as driving under influence or other moving traffic violations. This document serves as proof of financial responsibility to law enforcement and the state. It guarantees that the driver maintains the minimum liability coverage mandated by Indiana law, ensuring that victims of any accidents caused by the driver are adequately compensated.

For many drivers in Indianapolis who face reckless driving charges, the SR-22 becomes a vital part of restoring their driving privileges. It helps establish a safer driving record and mitigates the risk associated with repeated offenses. By fulfilling the requirements of an Indiana SR-22 for Reckless Driving Convictions, motorists can show a commitment to responsible driving behavior, potentially leading to lower premiums and improved trust from insurers over time.

The Process of Obtaining an SR-22 in Indiana

Obtaining an Indiana SR-22 for Reckless Driving Convictions involves a specific process designed to ensure compliance with state regulations after a driving conviction related to certain driving offenses, such as criminal recklessness. Drivers must first have a car insurance policy that offers liability coverage before filing for the SR-22. This document acts as proof of financial responsibility, confirming that the driver has sufficient coverage in case of an accident involving their vehicle or other cars. The steps to file an SR-22 in Indiana include contacting an insurance provider to request the filing, ensuring the auto insurance policy meets the state's minimum requirements, and paying any associated fees. Understanding this process is essential for those looking to regain their driving privileges and navigate the effects of their reckless driving conviction.

Eligibility Requirements for Reckless Driving Convictions

Indiana law mandates specific eligibility criteria for those seeking Indiana SR-22 for Reckless Driving Convictions. A reckless driving ticket can result in a conviction that classifies the individual as a high-risk driver. This category includes various serious offenses such as DUI convictions and other driving offenses that compromise safety on Indiana roadways. As a result, Indiana drivers with these convictions must navigate the SR-22 filing process to maintain their driving privileges.

To be eligible for Indiana SR-22 for Reckless Driving Convictions, the Indiana motor vehicle department requires proof of financial responsibility. This requirement is particularly stringent for those who have committed reckless driving offenses. Not only must drivers show evidence of appropriate insurance coverage, but they also need to be aware that these convictions can have significant implications for their insurance rates and driving records. The repercussions of a reckless conviction extend beyond immediate penalties, affecting future insurability and costs for Indiana drivers.

Steps to File an SR-22 in Indiana

Filing for an Indiana SR-22 for Reckless Driving Convictions involves several straightforward steps that Indiana drivers must follow. First, individuals convicted of serious road violations, such as a DUI or OWI conviction, need to contact their auto insurance provider. Not all insurers offer SR-22 auto insurance, so it is crucial to ensure that your current provider can issue the necessary paperwork. Once confirmed, the insurer will prepare the SR-22 form, which serves as proof of financial responsibility to the Indiana court.

After obtaining the SR-22 form, it must be submitted to the Indiana court overseeing the case. This submission must happen within a specific timeframe mandated by the court. Once the SR-22 insurance refers to a filing that covers the required period, drivers must maintain their coverage to avoid further penalties. If there are any lapses in insurance coverage, serious consequences may arise, including the possibility of additional fines or extensions of the suspension period related to the felony traffic violation.

Impact of Reckless Driving Convictions on Insurance Rates

Reckless driving convictions significantly impact insurance rates for Indiana residents. After receiving an Indiana SR-22 for Reckless Driving Convictions, the associated sr-22 insurance certification tells insurers that the driver is high risk due to serious traffic violations. An intoxicated conviction or a DWI conviction can further exacerbate premium increases, leading to a substantial financial burden. SR-22 compliance becomes essential for maintaining the ability to stop driving legally in Indiana. While the SR-22 remains on record, drivers often face elevated rates that reflect their risk profile, making it crucial to understand the long-term implications of these convictions on their overall insurance costs.

How Reckless Driving Affects Your Premiums

Reckless driving convictions lead to higher insurance premiums due to the increased risk assessed by insurers. An Indiana SR-22 for Reckless Driving Convictions signifies that a driver must meet specific requirements, making it essential to understand the implications of this certification. The sr-22 insurance filing acts as proof of financial responsibility, which could result in substantially elevated rates. Driving-related violations, particularly those involving reckless behavior, significantly influence the cost of sr-22 policies as insurers account for the likelihood of future infractions.

The repercussions of reckless driving extend beyond immediate premium increases. Drivers face potential long-term financial consequences, including an indefinite driving suspension if they fail to maintain necessary sr-22 certifications. Insurers often utilize sr-26 filings to confirm when a driver no longer needs sr-22 insurance, but until that time, maintaining vehicle liability protection becomes crucial. For those seeking lower costs, exploring sr-22 alternatives or considering an individual sr-22 may help mitigate some financial strain while ensuring compliance with state regulations.

| Violation Type | Impact on Premiums | Potential Long-term Consequences |

|---|---|---|

| Reckless Driving | Significant increase (20-50%) | Long-term financial strain and possible driving suspension |

| Speeding | Moderate increase (10-30%) | Higher rates for 3-5 years |

| DUI | Severe increase (30-100%) | Indefinite impact on premiums, risk of license suspension |

| Accidents | Variable increase (15-40%) | Long-term increase depending on fault |

Long-Term Financial Consequences

The financial ramifications of an Indiana SR-22 for Reckless Driving Convictions can be significant for offenders. After being convicted of serious traffic infringements, individuals may face higher insurance premiums due to their driving history. Insurance companies typically view reckless driving as a major red flag, leading to increased rates that can persist for several years. Maintaining the SR-22 continuously is crucial, as a lapse could result in losing driving privileges, further complicating the situation.

Driving skills may be scrutinized, especially for those with DWI convictions or multiple court-related offenses. An original SR-22 filing might evolve into an effective SR22, reflecting the driver's renewed commitment to safe driving. The duration of the SR-22 requirement is often influenced by the severity of the serious traffic ticket received. Ultimately, the financial consequences of maintaining an actual SR-22 filing can lead to lasting effects on an individual's budget and insurance options in Indiana.

Alternatives to SR-22 Insurance

For drivers facing Indiana SR-22 for Reckless Driving Convictions, understanding alternatives can provide essential options. While SR-22 filings are typically a necessity following numerous speeding or repeat offenses, specialized driving privileges or a hardship license may be available to those who need to maintain their mobility despite license suspension. These options allow individuals to drive legally without the full burden of an SR-22 insurance policy when certain conditions apply. It’s crucial to consult the Indiana BMV to explore the specific requirements and eligibility for these alternatives, as well as the potential benefits of a hardship license over an SR-22 certificate. Evaluating all possibilities helps ensure that drivers can navigate the complex landscape of Indiana SR-22 for Reckless Driving Convictions while seeking the best outcome for their circumstances.

Options for High-Risk Drivers

High-risk drivers in Indiana facing suspensions due to reckless driving convictions and other serious traffic violations may explore various options to maintain their driving privileges. Hardship licenses can offer a path forward, allowing individuals to drive for necessary activities despite their license suspensions. An effective SR-22 policy serves as proof of financial responsibility, often required after certain traffic violations, including reckless driving. Obtaining Indiana SR-22 for Reckless Driving Convictions can be crucial in reinforcing one's commitment to safe driving while enabling access to essential transportation.

Seeking alternatives to traditional coverage may also benefit those with a history of experienced Indiana DUI incidents or other driving infractions. Some insurers might offer policies tailored for high-risk drivers, ensuring compliance with the state’s requirements without excessive traffic fines or premiums. While navigating the complex landscape of SR-22 insurance coverage, understanding the five-year driving privilege period is essential for managing license reinstatement. High-risk drivers should carefully consider their options to effectively address their SR-22 need and make informed decisions for the future.

- Consider applying for a hardship license to maintain essential driving privileges.

- Research insurance providers that specialize in coverage for high-risk drivers.

- Stay informed about the requirements for SR-22 insurance to ensure compliance.

- Keep track of the five-year period related to driving privileges and reinstatement.

- Attend defensive driving courses to improve driving skills and possibly reduce insurance rates.

- Regularly review and compare insurance quotes to find the best rates and coverage options.

- Seek advice from a legal expert to navigate the complexities of traffic violations and insurance requirements.

Non-Owner SR-22 Insurance

High-risk drivers in Indiana often face the challenge of obtaining SR-22 coverage after a major offense, such as reckless driving. For those without a vehicle, the Indiana SR-22 for Reckless Driving Convictions can still be acquired through non-owner SR-22 insurance. This type of policy meets the state motor vehicle requirements while allowing individuals to fulfill their sr22 filing obligations. Even if drivers have a suspended license, they can still apply for specialized driving privileges through this insurance option, ensuring they remain compliant with Indiana regulations.

Choosing a non-owner SR-22 policy may also provide the opportunity to lower insurance premiums over time. Completing a defensive driving course can further demonstrate a commitment to safe driving, potentially influencing future rates. The Indiana Department of Motor Vehicles recognizes these factors when assessing sr-22 requirements and can assist high-risk drivers in navigating the complexities of sr22 coverage. Drivers need to be aware that securing this type of insurance will allow them to maintain their status while working towards regaining a standard sr-22 in the future.

Common Myths About SR-22 Insurance

Many misconceptions surround Indiana SR-22 for Reckless Driving Convictions, leading to confusion for drivers. One common myth is that maintaining SR-22 coverage is unnecessary if you have a good driving record. In reality, the SR-22 requirement persists for those with multiple traffic violations, impacting their insurance rates significantly. Some believe that an SR-22 insurance lapse only affects their premiums temporarily; however, it can lead to serious consequences, including increased scrutiny from the Indiana Bureau. Understanding the nuances between SR-50 and SR-26 forms is essential, as they relate to different aspects of liability protection. Clarity about these factors can help drivers navigate the complexities of their driving records and SR-22 obligations.

Misconceptions Regarding Coverage

Many drivers believe that Indiana SR-22 for Reckless Driving Convictions offers comprehensive coverage for all driving-related issues. This is a common misconception. While SR-22 insurance serves as proof of financial responsibility following a significant traffic violation, such as a reckless driving conviction, it does not cover damages incurred from future incidents or minor violations. Instead, it helps risky drivers comply with state requirements after a serious violation, showcasing their intent to drive legally and safely.

Another misunderstanding is that the costs associated with sr-22 insurance are the same for every driver. Rates may vary significantly based on individual driving histories and the nature of the violations. While serious traffic infractions like reckless driving often result in higher premiums, Indiana offers varying insurance options that could fit different budgets. Drivers considering an SR-22 form filing should be aware that the cost reflects not just the coverage itself but also their overall risk profile in the eyes of insurers.

Clarifying Duration and Cost

The duration of an Indiana SR-22 for Reckless Driving Convictions typically lasts for two years from the date of the offense. During this period, the driver must carry SR22 insurance to demonstrate financial responsibility. Failing to maintain this coverage could result in additional penalties, including license suspension. Understanding the SR-22 requirement is essential for meeting state-mandated regulations and avoiding further violations.

Cost plays a significant role in the SR-22 process. Drivers may experience a substantial increase in insurance premiums due to the reckless driving conviction. This expense can vary based on factors such as the driver's prior history and the type of coverage, including harm liability coverage. Some may even find themselves needing an FR-44 form if they incur additional violations. Maintaining a clean driving record after this period is crucial for regaining favorable rates and ensuring long-term financial stability.

Special Considerations for SR-22 Renewals

Renewing an Indiana SR-22 for Reckless Driving Convictions involves several important considerations for drivers. It is crucial to maintain continuous liability coverage throughout the renewal period to avoid penalties and ensure compliance with state regulations. Drivers should be aware that their state residency may affect their renewal process, particularly if they change addresses or switch insurance providers. SR-22 filings are connected to pointable moving traffic violations, and any new infractions can impact insurance rates and renewal eligibility. Maintaining a clean driving record while operating a vehicle with required coverage can aid in navigating these complexities effectively. Understanding the specifics of Indiana SR-22 for Reckless Driving Convictions is essential for securing a better insurance outcome post-renewal.

- Ensure continuous liability coverage to avoid penalties.

- Be aware of how state residency changes can impact the renewal process.

- Notify your insurance provider promptly if you change addresses or insurance companies.

- Monitor your driving record for any new infractions that could affect your renewal.

- Shop around for insurance to find better rates if your SR-22 leads to increased premiums.

- Consider taking a defensive driving course to improve your driving record and potential insurance rates.

- Keep all SR-22 documentation organized and easily accessible for the renewal process.

Conclusion

The process surrounding Indiana SR-22 for Reckless Driving Convictions is critical for Indiana residents who face serious traffic violations. An SR-22 is not an insurance policy but a certification that proves compliance with state minimum coverage requirements. Following an intoxicated conviction or DWI conviction, individuals may be required to obtain this certification to stop driving legally. SR-22 insurance tells the state that the driver has the required liability coverage, while the costs associated with SR-22 insurance can impact long-term financial stability. It is essential to understand that the SR-22 remains in effect for a designated period, ensuring continued compliance with state law. Understanding these elements helps drivers navigate the complexities of SR-22 insurance certification and maintain their driving privileges.

FAQS

What is an SR-22 and why is it needed after a reckless driving conviction?

An SR-22 is a financial responsibility document required by the state of Indiana to prove that you have the minimum required insurance coverage after being convicted of reckless driving. It acts as a guarantee to the state that you are maintaining your insurance.

How long do I need to keep an SR-22 after a reckless driving conviction in Indiana?

In Indiana, you are typically required to maintain an SR-22 for two years following your reckless driving conviction. However, this duration can vary based on individual circumstances and the specifics of your case.

Will my insurance premiums increase if I have an SR-22 due to reckless driving?

Yes, having an SR-22 due to a reckless driving conviction usually results in higher insurance premiums. Insurance companies consider reckless driving a serious offense, which increases the perceived risk of insuring you.

Can I drive a vehicle that I do not own with an SR-22?

Yes, you can drive a vehicle that you do not own as long as you have a non-owner SR-22 insurance policy. This type of coverage is specifically designed for individuals who need to meet SR-22 requirements but do not own a vehicle.

Are there alternatives to obtaining an SR-22 for reckless driving?

Unfortunately, if you are required to have an SR-22 due to a reckless driving conviction, there are no alternatives to meeting this requirement. However, you can shop around for different insurance providers to find the most affordable SR-22 insurance options.

What should Indiana drivers know about SR-22 requirements following a serious driving violation such as reckless driving?

In Indiana, drivers involved in serious driving violations, like reckless driving, may be required to obtain SR-22 insurance. This SR-22 insurance requirement tells the state that the driver is maintaining a certain level of liability coverage after a major traffic violation. Typically, the effective SR22 policy indicates that the driver must maintain SR22 coverage for a designated period, often between one to three years. Failing to maintain SR-22 coverage can lead to a lapse, which affects both drivers’ license status and insurance rates. In Indiana, the responsibilities may vary, and drivers should consider these factors when looking into the costs associated with SR-22 insurance, including minimum liability car insurance and injury liability.

What are the implications of a high-risk traffic incident for Indiana drivers regarding SR-22 insurance rates and requirements?

Indiana drivers involved in a high-risk traffic incident, such as a single DUI conviction or reckless driving, may find themselves facing specific SR-22 requirements. SR-22 insurance is necessary for drivers considered high risk, and it tells the state that they are covered. The SR-22 insurance costs can vary, and a coverage lapse might affect future SR-22 insurance rates. It is essential for Indiana drivers to maintain good driving records to reduce the potential financial burden of SR-22 insurance and related costs, like the SR-50 or SR-26 forms when needed.

How do moving violations affect the SR-22 requirement for Indiana drivers?

In Indiana, the SR-22 requirement is triggered by moving violations such as reckless driving. The SR-22 insurance isn’t just a matter of filing a form; it also indicates to the state that the driver has the necessary SR-22 coverage to stay compliant. Indiana drivers must understand that the SR-22 tells the insurance company to provide proof of insurance for a specified period. The exact duration of the SR-22 requirement depends on the severity of the violations, and Indiana drivers must maintain their SR-22 regardless of any vehicle while operating other vehicles, which includes maintaining the SR-22 coverage even during any lapse in vehicle coverage, like an SR-22 coverage lapse.

How does the SR-22 requirement in Indiana depend on the severity of a driver's reckless driving conviction?

In Indiana, the SR-22 requirement for drivers is dependent on the specifics of their conviction for reckless driving. Indiana drivers may find that they need to file an SR-22, which is a certificate of financial responsibility, regardless of the specific circumstances. The requirement can vary based on the offense, and in some cases, they may need to obtain a certain type of SR-22 such as SR50 or SR26, depending on their individual situation.

How does the SR-22 requirement for Indiana drivers vary based on their driving history and offenses?

In Indiana, the SR-22 requirement can depend significantly on the driver's history and the severity of their offenses. For Indiana drivers, certain violations may trigger the need for SR-22/FR-44 insurance, and this requirement remains in effect regardless of other factors. Specifically, the SR-22 requirement may vary based on the type and number of violations, but it ultimately depends on whether the driver poses a high-risk to the insurance market.

How do reckless driving convictions impact the SR-22 requirement for Indiana drivers?

The SR-22 requirement for Indiana drivers depends on various factors, including the severity of the reckless driving conviction. Indiana mandates this form of insurance for high-risk drivers, meaning that regardless of the specific offense, if a driver is deemed to pose a risk, they may need to obtain an SR-22.

How does the SR-22 requirement for Indiana drivers depend on their individual circumstances and history of violations?

The SR-22 requirement for Indiana drivers can vary significantly based on different factors, including the severity of offenses and the driver’s history. In Indiana, the SR22 requirement depends on the type and frequency of violations, and drivers may need to obtain an SR22 regardless of their previous driving records.

How does the SR-22 requirement in Indiana depend on the circumstances surrounding a driver's reckless driving conviction?

The SR-22 requirement for Indiana drivers depends significantly on the specifics of their reckless driving conviction, including factors such as the severity of the offense and the driver's prior driving history. Indiana drivers may face varying requirements based on their individual circumstances, which can influence their insurance rates and the duration for which they need to maintain SR-22 coverage.

How does the SR-22 requirement for Indiana drivers change under different circumstances following a reckless driving conviction?

The SR-22 requirement for Indiana drivers depends on various factors, including the severity of the offense and any previous driving violations. In Indiana, drivers must maintain their SR-22 insurance for a set period, which also depends on their individual history and circumstances surrounding their reckless driving conviction.

How do the SR-22 requirements for Indiana drivers change based on their individual circumstances?

The SR-22 requirement for Indiana drivers often depends on various factors including the severity of the traffic violations and the drivers' histories. In Indiana, the specifics of each case vary, and understanding how these individual circumstances influence insurance requirements can help drivers navigate their obligations effectively.